"Rising Tides: How Soaring Home Insurance Costs Are Reshaping Louisiana’s Real Estate Landscape"

Rising Home Insurance Costs in Louisiana: A Crisis for Homeowners

By Claire Brown and Mira Rojanasakul

Photography by Emily Kask

Published: November 19, 2025

In Lafitte, Louisiana, a small coastal community, Sandra Rojas, a fifth-generation resident, faces a staggering increase in her home insurance premium, which has surged to $8,312 this year—more than double what she paid four years ago. This alarming trend is not isolated; homeowners across Louisiana are grappling with similar hikes, with some expecting to pay up to 45% more for coverage this year alone.

The Broader Impact of Rising Insurance Costs

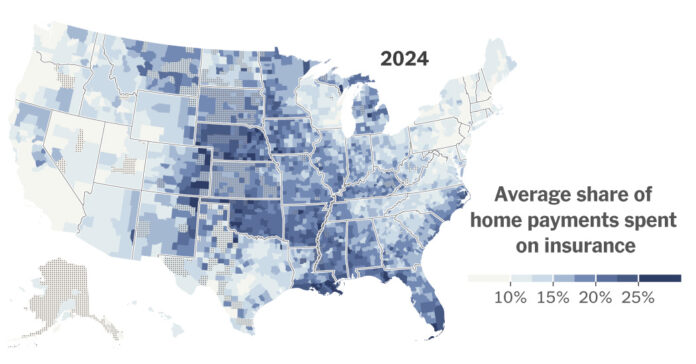

Recent research shared with The New York Times reveals that skyrocketing home insurance premiums, largely driven by climate change, are reverberating through the real estate market, significantly impacting home values in disaster-prone areas. The study, which analyzed tens of millions of housing payments through 2024, indicates that homes in the most vulnerable ZIP codes—those exposed to hurricanes and wildfires—are selling for an average of $43,900 less than they would under normal circumstances.

The study’s authors, Benjamin Keys from the Wharton School and Philip Mulder from the University of Wisconsin-Madison, describe this phenomenon as a “reinsurance shock.” As global reinsurance companies have doubled their rates in response to increasing climate risks, the financial burden on homeowners has intensified.

The Local Experience: Lafitte and Beyond

Rojas’s predicament is emblematic of a larger crisis. With home values in Lafitte dropping by 38% since 2020, many residents are finding themselves trapped. “They won’t insure you,” Rojas lamented. “No one will buy from you. You’re kind of stuck where you are.”

The situation is echoed in Bogalusa, Louisiana, where Cristal Holmes saw her insurance premium quadruple to $500 per month in 2022. As a single mother working long hours, she struggled to keep up with rising bills, ultimately falling behind on her mortgage payments. Real estate agent Charlotte Johnson reports that her office receives daily inquiries from clients unable to afford their escalating insurance costs.

The National Landscape: A Growing Crisis

The crisis is not confined to Louisiana. In Colorado, where wildfires and hail pose significant threats, the average homeowner’s insurance premium has more than doubled in the last decade, with a 74% increase since 2020. In California, 13% of real estate agents reported deals falling through in 2024 due to buyers being unable to secure affordable insurance.

As insurance costs rise, home values must adjust to remain affordable for potential buyers. This adjustment could lead to lower property tax revenues, impacting local governments’ ability to fund essential services.

The Financial Burden on Homeowners

For many homeowners, the rising costs of insurance are becoming unsustainable. In Orleans Parish, Louisiana, insurance now accounts for nearly 30% of the average homeowner’s total housing payments, which include mortgage costs and property taxes. This financial strain is forcing homeowners to make difficult choices, such as accepting unaffordable insurance policies or risking foreclosure.

Clarence Guidry, another Lafitte resident, received a quote for a $20,000 annual premium with a $50,000 deductible for hurricane damage. Faced with such exorbitant costs, he opted to self-insure, a risky decision that reflects the desperation many homeowners feel.

The Underlying Causes of the Crisis

The rapid increase in insurance premiums can be attributed to several factors, including rising construction costs, higher interest rates, and the impact of climate change. Over the past decade, losses from natural disasters have outstripped the revenue insurance companies receive from home insurance policies. In Louisiana alone, 12 insurance companies became insolvent following a series of hurricanes between 2021 and 2023.

As reinsurers reassess risk based on sophisticated data analysis, the cost of insuring homes in vulnerable areas continues to rise. Dr. Mulder notes that these changes are reshaping the insurance landscape, making it increasingly difficult for homeowners to secure affordable coverage.

The Future of Homeownership in High-Risk Areas

As the insurance crisis unfolds, the implications for homeowners and the real estate market are profound. Jesse Keenan, an associate professor at Tulane University, warns that the New Orleans housing market is showing signs of distress, with home prices increasing at a rate lower than inflation since 2018.

While some states have implemented regulations to keep insurance costs down, the overall trend suggests that homeowners will continue to face rising premiums. In California, new rules allow insurers to pass on rising reinsurance costs to consumers, potentially leading to significant increases in net premiums.

Conclusion

The rising costs of home insurance in Louisiana and across the nation represent a growing crisis that threatens the stability of the housing market. As homeowners like Sandra Rojas and Cristal Holmes navigate this challenging landscape, the need for comprehensive solutions becomes increasingly urgent. Without intervention, the dream of homeownership may slip further out of reach for many, particularly in areas most vulnerable to climate-related disasters.